MANIFEST

Making Retirement

Plans Healthier

Manifest engages active and inactive participants, increasing engagement while lowering an employer's financial burden by 20%.

A look into retirement plans

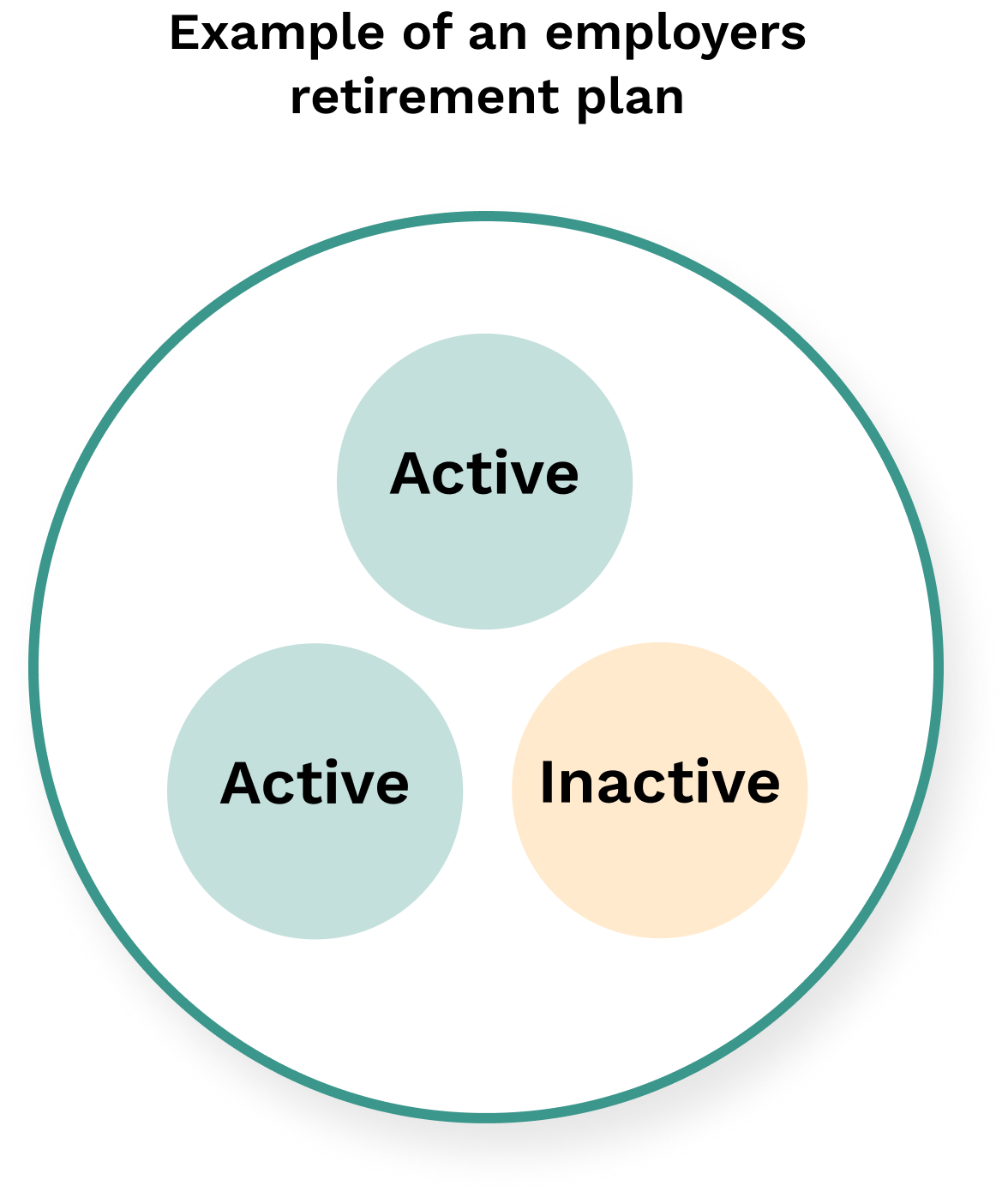

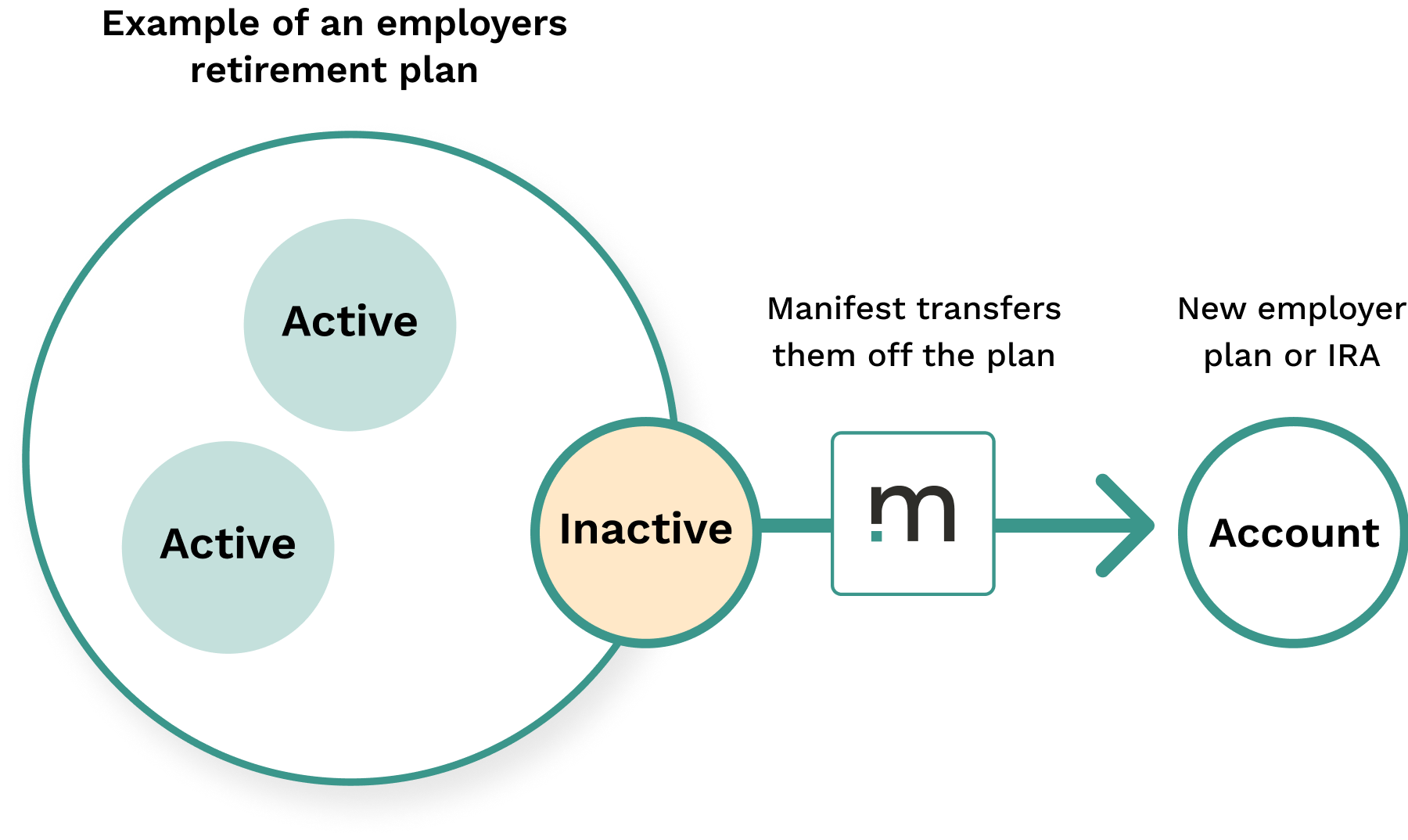

In all retirement plans, there are two categories of participants, Active and Inactive.

Active Participants

Current employees are involved in their accounts and actively contribute.

Inactive Participants

Ex-employees that left the company, leaving their accounts to collect dust.

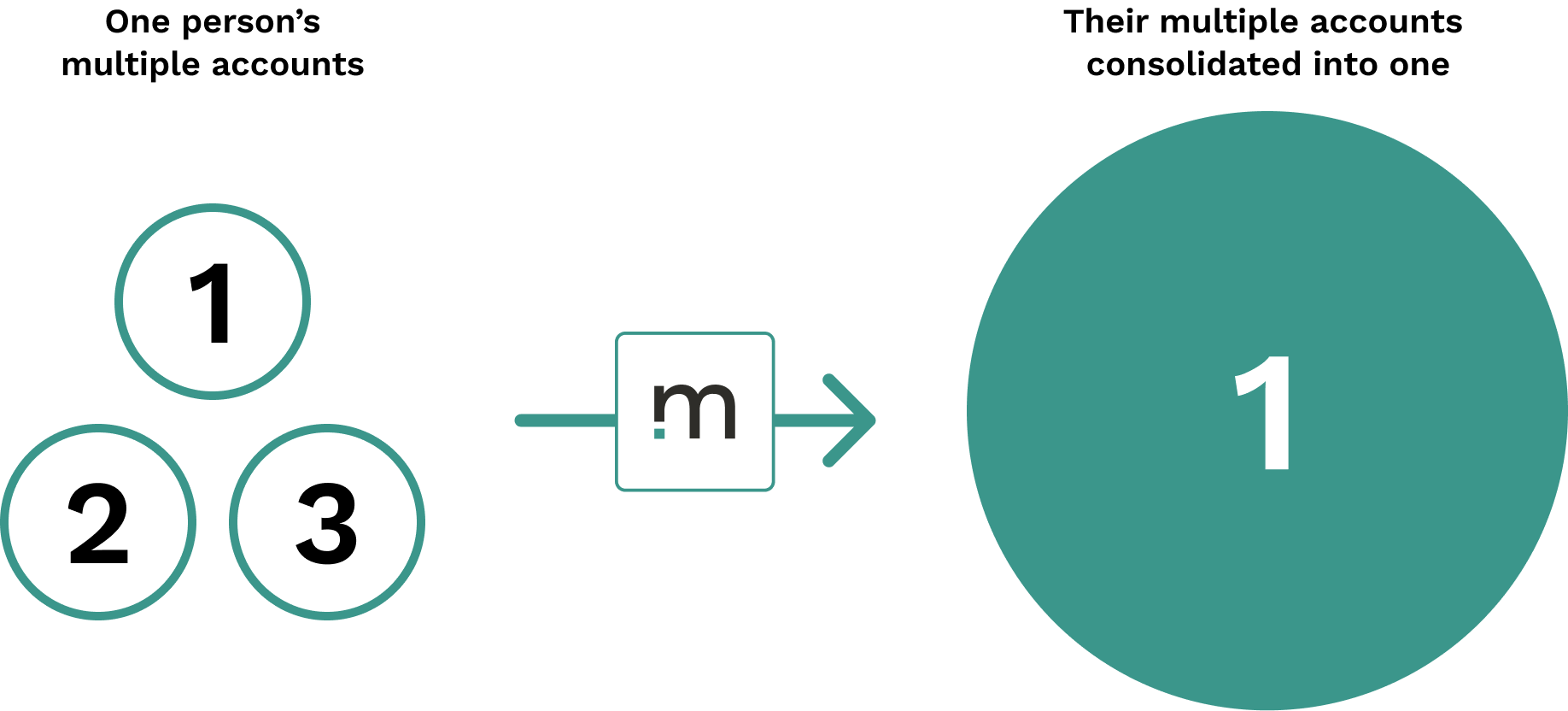

Manifest increases engagement

The average worker has nearly three retirement accounts. Manifest

consolidates those accounts into their current employer-sponsored account.

Manifest Helps You Control Your Costs

These old accounts cost the employer money each year and increase their liability. Manifest engages inactive participants and transfers their funds.

Lower employer's cost by 20%

Save $540 per account over 5 years

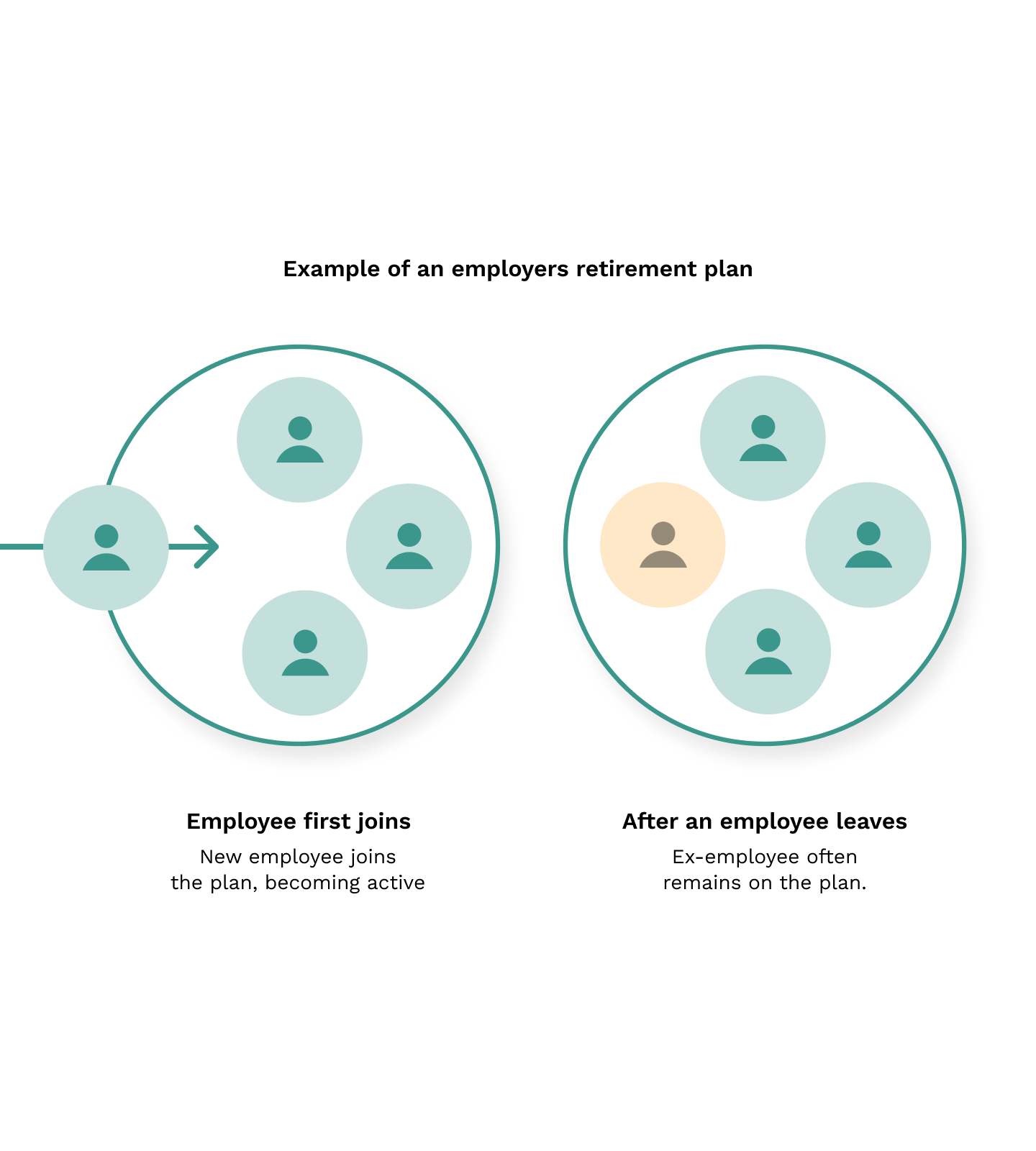

About the Natural Turnover Cycle

As your company grows, the natural turnover process runs its course.

Unavoidably, your retirement plan will accumulate more and more inactive members.

Typically, there are two Inactive for each Active participant.

Common FAQs

Zero integrations, zero costs, and zero long term contracts - go live with us in less than an hour!

Manifest's participant application is distributed through employers, and is just a URL! Paste our link in email, chat, SMS - however you can imagine.

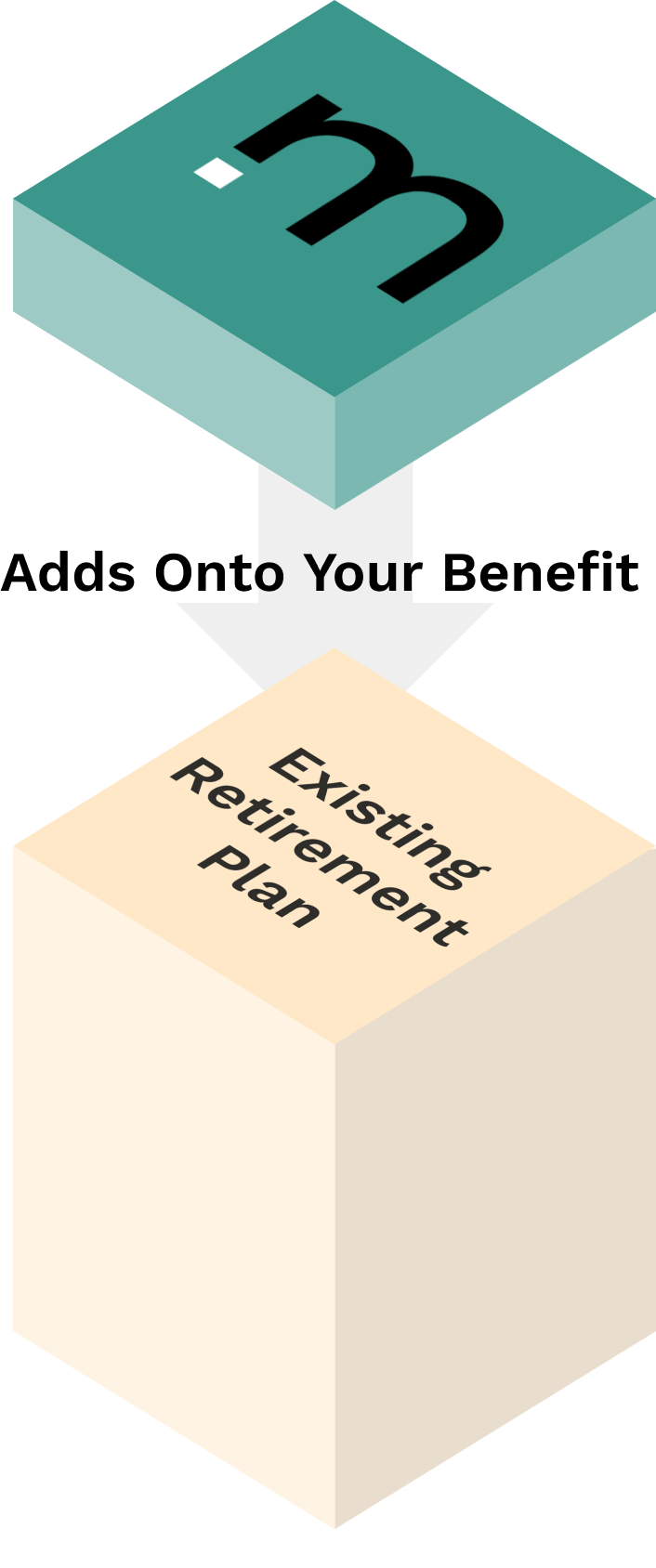

Manifest is an add-on that supercharges any employer's existing retirement benefit, regardless of your service provider or size.

Manifest can transfer all defined contribution accounts, such as 401(k)'s, 403(b)'s, TSP's, and more.

By making account consolidation easy, Manifest increases engagement within a plan, leading to higher contribution rates and decreased cash out risk. These factors and more lead to a $13,450 average increase in account balance.

In addition to increased assets and greater engagement, the combination of reduced liabilities and increased negotiating power can lead to a 20% reduction in plan costs for our employer clients.