Trusted by participants at

Supercharge your 401(k)

Every job change can put your teammate's nest eggs at risk. The workforce is trending towards mobility. 88% of employees ranked saving for retirement as their highest financial stressor.

Manifest is an add-on to any defined contribution plan. Our product helps your employees maximize their retirement outcomes by making consolidation a breeze.

Financial stability today for financial security tomorrow

The average employee has 2.8 old accounts lying around. Manifest has the power to drive engagement and empower you to control your plan costs.

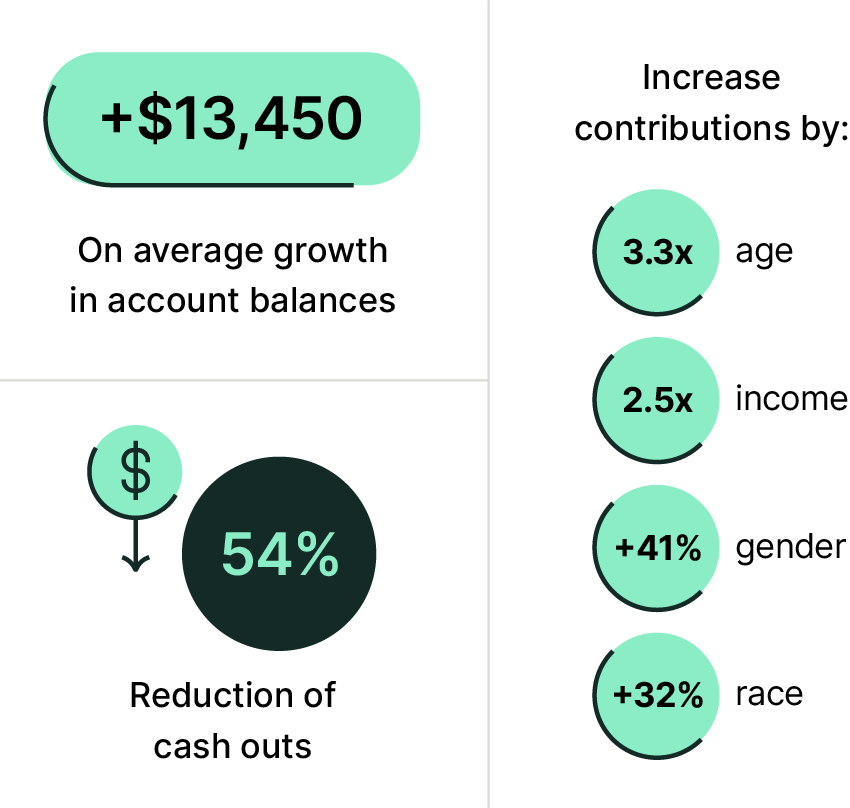

Knock your DEI initiatives out of the park! Younger participants, minorities, women, and folks with lower incomes have been historically difficult to engage. By increasing the probability of your retirement benefits, Manifest has been able to increase savings, especially in hard to reach groups.

Why Manifest?

A no-cost benefit that makes a real, measurable impact

Many employee benefit ecosystems include financial literacy but lack the products to drive action. Manifest drives consolidation now, and our impact compounds over time.

Cut 401(k) costs by up to 20%

Growing average account balances gives our clients negotiating power to lower their overall 401(k) plan fees. Additionally, we remove inactive accounts that can cost $72 per year to maintain.

Enhance your Diversity, Equity, and Inclusion strategy

The most vulnerable employees within an organization are the ones most likely to be experiencing financial stress. Providing these employees with access to Manifest is responsible - and improves overall employee retention as a result.

Featured in

Go live in minutes

Sign up today, and go live in less than an hour without integrations or tedious enterprise contracts.

Control

Employers control who receives Manifest's URL - active, inactive, or both groups of participants.

Flexible

Employers no longer field rollover questions. Manifest's team of advisors are trained for 24-hour support.

Compliant

Manifest facilitates direct provider-to-provider rollovers. No one else, including Manifest, can touch users' savings.

Secure

Manifest's team has a long history of building enterprise solutions. Our read-only system is designed to protect confidential data.